⌘ + R versus ⌘ + S: A Tale of Two Startups

A look at the resurgence of keyboard-first apps, and a deep dive into the growth of Raycast and Slapdash—two startups with contrasting strategies competing for developer mind share.

1.0. An Unlikely Thought Experiment

A peculiar thing about Y Combinator (YC) as a startup accelerator is that, they don’t mind funding multiple teams with the same idea, because they provide venture capital at a very early stage—the stage where an idea is most likely to change—and they acknowledge as much in their FAQ:

Will you fund multiple startups working on the same idea?

Yes. If you fund as many companies as we do, some overlap is unavoidable. Even if we tried not to accept competing companies, you'd still get overlap because startup ideas morph so much. The way we deal with it is that when two startups are working on related stuff, we don't talk to one about what the other's doing.

In practice it has not turned out to be a problem, because most big markets have room for several slightly different solutions, and it's unlikely that two startups would do precisely the same thing.

In practice, they’ve funded quite a few startups that went on to launch similar products seeded from the same idea, though a few of those products were seeded from dissimilar ideas. Here’s a non-exhaustive list of such startups:

product analytics1: Mixpanel (S09), Amplitude (W12), Heap (W13), PostHog (W20), June (W21);

customer data platform (CDP)2: Segment (S11), Freshpaint (S19), Jitsu (S20);

payment gateway: Paystack (W16), Flutterwave (S16);

extract, transform and load (ETL): Fivetran (W13), Airbyte (W20).

As a thought experiment, I’ve always pondered an unlikely scenario: given two startups making similar products that target the same customers, can one analyze their strategy to make an educated guess as to which of the two startups will experience the most growth?

Stated more explicitly, given two startups making similar products that target the same customers, but with different growth strategies, can we use publicly available information to determine which strategy will lead to the most growth, after a 2-year period?

1.1. Enter: Launch Hacker News

Launch HN, or LHN, for short, are startup launch posts that are exclusive to HN3. LHN posts represent a growing but currently underrated way of discovering new startups, especially those making developer tools.

These launch posts are effective for generating awareness and/or soliciting feedback precisely because the community finds them interesting. This isn’t an accident—launch posts are written in a certain style which exhorts founders to avoid marketing-speak since they are pitching to their peers. In addition, the style guide asks that founders gives answers to the following questions: “what problem you solve, why it matters, how you solve it, and how you got there”.

Through LHN posts, I’ve found more than a dozen startups working on interesting problems in the developers tools space.

But a fascinating coincidence happened in 2020 that is worth revisiting.

1.2. Initial Growth Story

Revisiting 2020, the Year of the Pandemic

Raycast and Slapdash are two YC funded startups with similar products (and identical business models) inspired by dissimilar ideas. Both startups used a Launch HN post to solicit feedback from the HN community in 2020.

I especially like this case study because, even though both companies are led by technical founders, they adopted strategies that are at opposite ends of the spectrum.

While Raycast had their Launch HN on March 2, 2020, Slapdash had theirs 6 months later on September 3, 2020, although Slapdash (YC W19) joined YC about a year earlier4 than Raycast (YC W20). Both companies were recently featured in a piece about unified search apps by Fast Company5.

So, how are they similar and how do they differ?6 Let’s dive in!

1.2.1. Launch HN: Raycast

Raycast’s initial launch on HN was well-received. Raycast uses a graphical user interface (GUI) that draws a lot of inspiration from Command Line Interfaces, or CLIs.

CLIs are popular amongst technical and power users because they allow almost any task to be accomplished very quickly, using only a keyboard. This is in stark contrast to the general population that favors a mouse and keyboard combo.

Their emphasis on a keyboard-first UI allows them to effectively target a small slice of that audience. Currently, that subset is developers, but it includes a few adjacent roles like designers and PMs7. They are currently only available as a native desktop app on macOS.

The founders’ pitch directly compared their product with far more established apps on macOS like Apple Spotlight and Alfred, but this didn’t stop the community from making interesting comparisons between Raycast and the following products: Command E, Wox + Everything Search & VS Code + extensions.

We will revisit these comparisons later.

1.2.2. Launch HN: Slapdash

Slapdash’s HN launch was highly up-voted and it generated a lot of discussion.

Like Raycast, Slapdash equally uses a command-line inspired interface, which they dub the “Command Bar”. In their pitch, the term Command Bar is a portmanteau of Command Line + Search Bar, and it aptly describes the broad app category that Slapdash and Raycast belong to, even though there’s a commercial product of the same name8 that makes an embeddable widget for cloud apps.

Unlike Raycast who are squarely focused on a developer audience, they target a more general audience of computer end users and to that end, their product is cross-platform—they support Linux, macOS & Windows.

The founders’ pitch described their product as a supercharged combination of Apple Spotlight + Finder for cloud apps, a kind of work OS for cloud apps if you will. Their pitch went on to make direct comparisons with internal products used at Meta and Stripe, FB Intern9 and Stripe Home, respectively.

The community made a few additional comparisons between Slapdash and these products: Akiflow, Alfred, Command E, Heyday, Nira & Quest.

1.2.3. Message-Market Fit

“The market's perception is your reality.”

There are two signals of member participation that are indicative that a launch post resonated really well with the HN community:

members vote up the launch post (to the high 2-digits or low 3-digits);

members leave comments that draw comparisons to alternatives (to better understand how the new product is different).

The second signal is a form of peer review, which is not surprising since the primary audience of LHN posts are indeeds peers10 and not users like in a Product Hunt launch.

1.2.4. Competitor Mentions

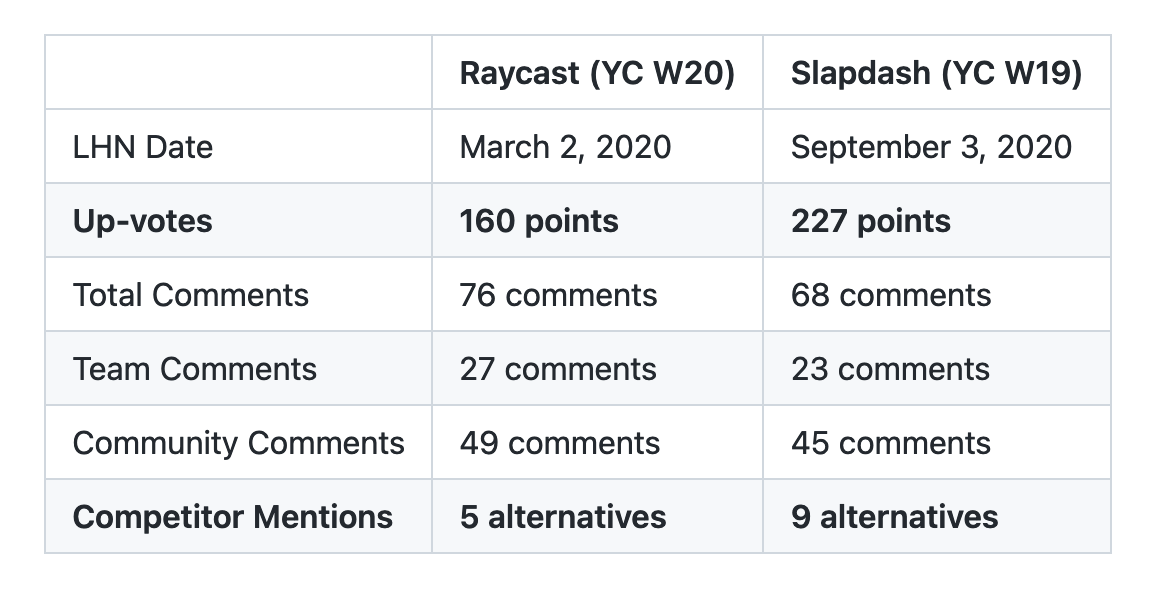

The stats from both LHN posts have been aggregated into the table below11.

Looking at the table, the pitch of Slapdash resonated so well with the HN community compared to the pitch for Raycast because:

they had more up-votes (227 points vs 160 points);

they had more competitor mentions than Raycast (9 vs. 5).

Let’s take a closer look at the actual competitor mentions by itemizing all of the competitor mentions from each LHN post.

1.2.4.1. Raycast Alternatives

Apple Spotlight — macOS only;

Alfred — macOS only;

VS Code + Extensions Marketplace — Linux, macOS & Windows;

Wox + Everything Search — Windows only.

1.2.4.2. Slapdash Alternatives

Alfred — macOS only;

Akiflow — macOS & Windows;

Command E — macOS & Windows;

FB Intern — Web browser;

Heyday (fka Journal) — Apple iOS, Google Chrome & Mozilla Firefox;

Stripe Home — Web browser.

1.2.4.3. Combined Alternatives

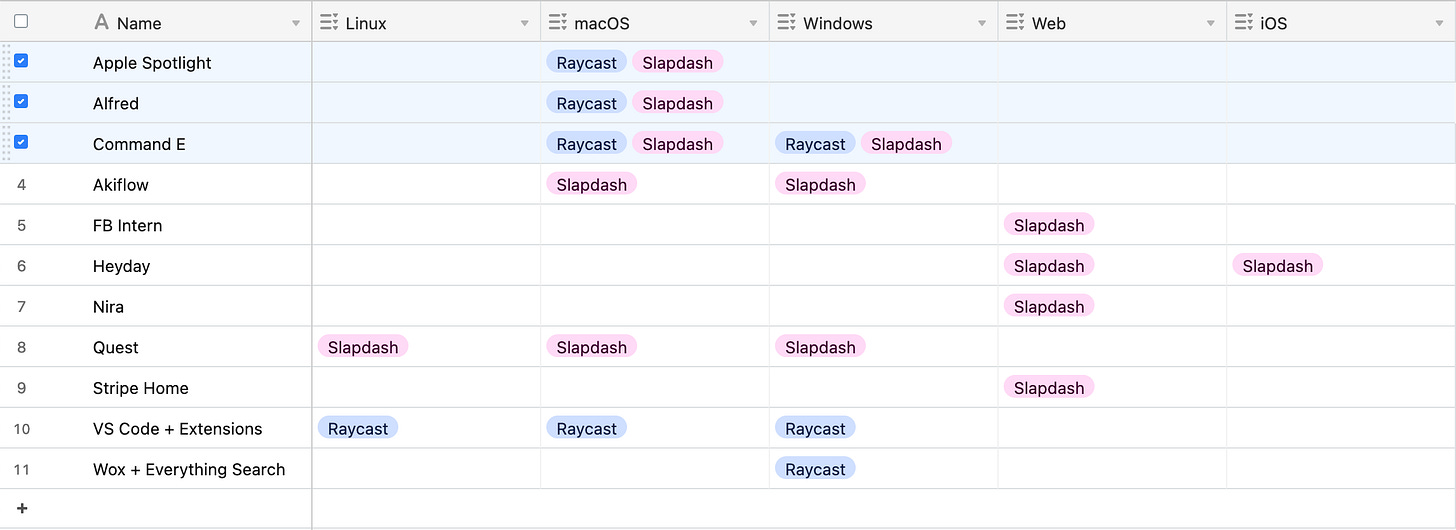

To make things easier, let’s combine the two lists of alternatives into an Airtable spreadsheet:

Looking at the spreadsheet, we see that Raycast and Slapdash both got compared with Apple Spotlight and Alfred, which are only available on macOS. They are perhaps the two best known apps in the app launcher/command bar category.

They also got compared to a third alternative: Command E, which is available on two platforms: macOS and Windows. Command E has since been acquired by Dropbox.

After these three products, there is no overlap in the competitor mentions, as is evident from the rest of the spreadsheet.

Slapdash clearly has more competitor mentions, plus its addressable market is broader, by virtue of their product and competitors’ products being available on more platforms to serve the needs of end users.

1.3. Current Growth Story

Fast Forward to 2022

Today, Raycast is still laser-focused on improving the experience on macOS, so they are still a single-platform app—available only to macOS users. They’ve grown from 13015 to more than 10,000 users16.

Slapdash OTOH, have been multi-platform from launch. They have since launched two browser extensions on the Google Chrome store17 for users of Chrome-based browsers, so they are now available on four platforms:

Linux

macOS

Windows

Web (Chrome-based browsers)

I couldn’t find publicly available info on the size of the user base for the desktop app, but their Chrome extension currently has 1,000+ users18.

Maintaining integrations with mainstream apps can act as an external trigger that reminds users to use a product19, which might explain why they also maintain a strong presence on third-party marketplaces—their existence can drive up user activation. They currently offer the following integrations: Asana integration, GitHub app, Google Chrome extension, HubSpot integration, Zoom integration.

In more concrete terms, how are they both faring today?

1.3.1. Traffic Statistics

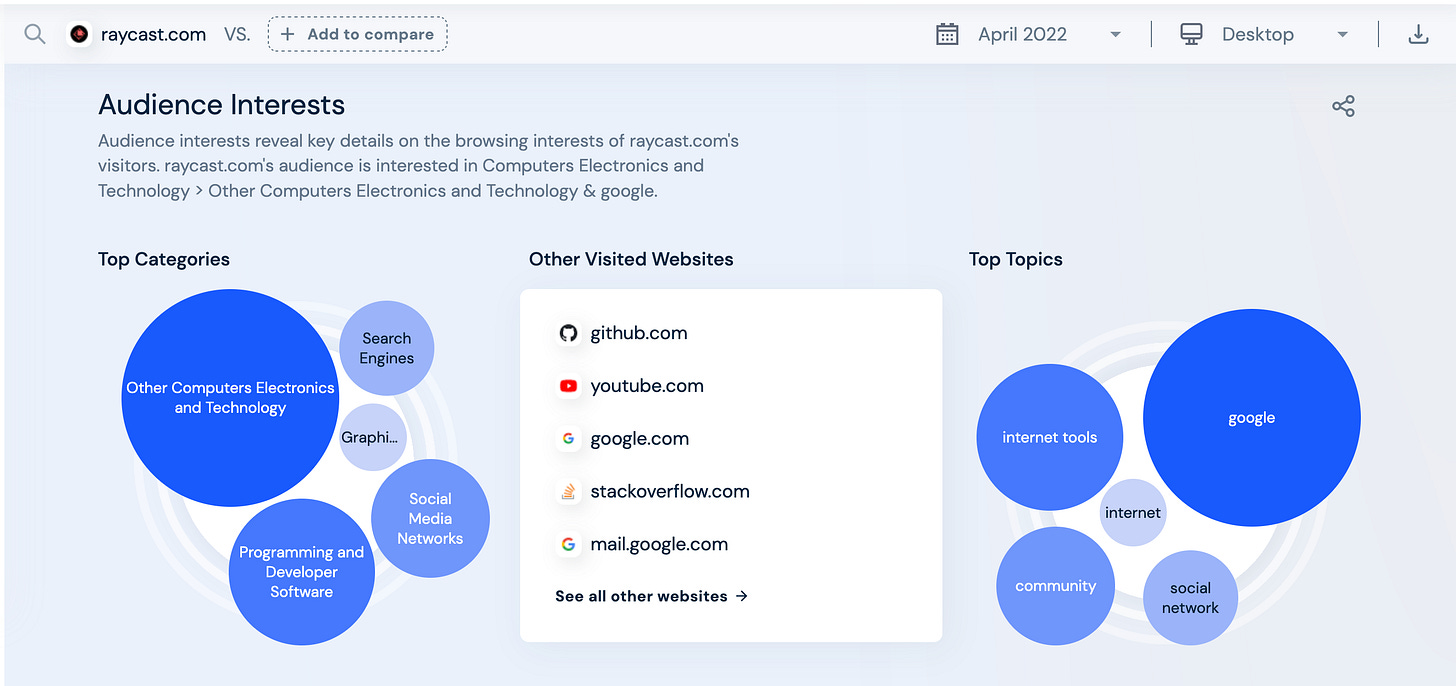

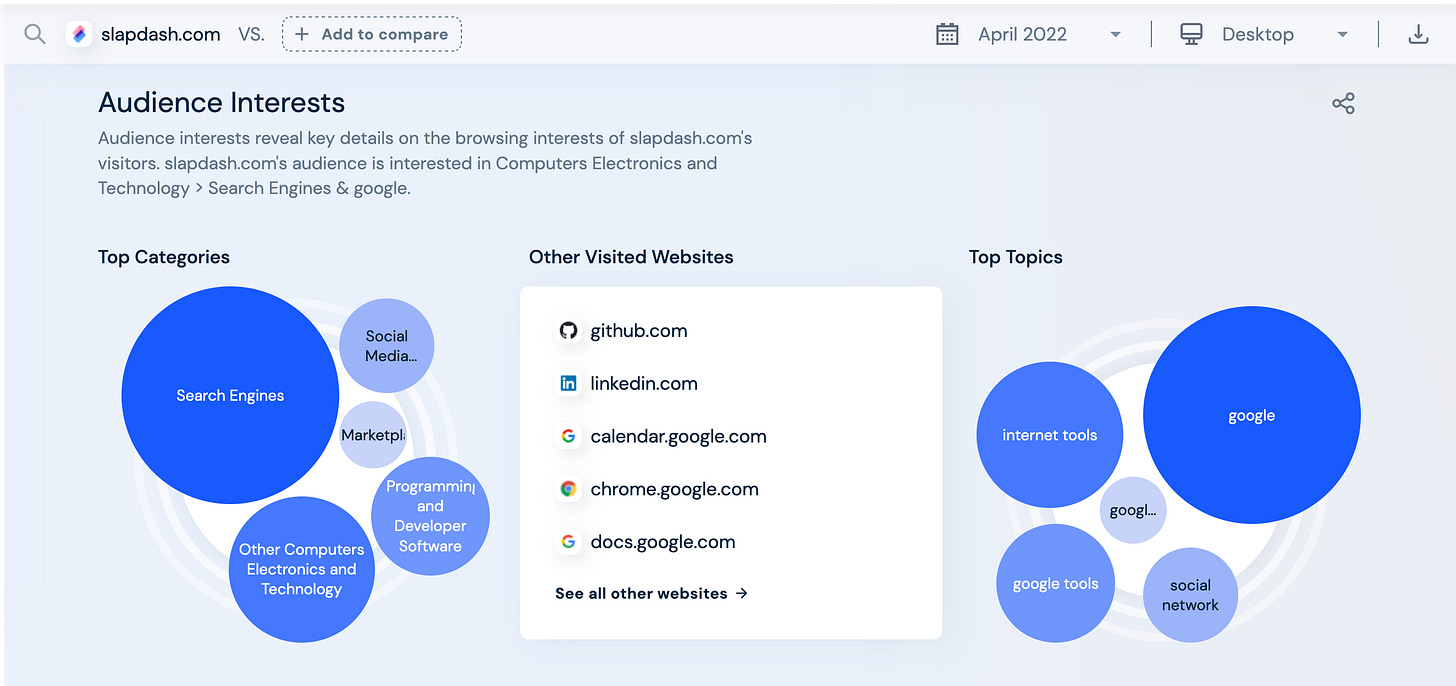

According to Audience Interests data from SimilarWeb’s traffic measurement product, Raycast and Slapdash both appeal to an audience with overlapping interests as can be seen in the screen shots below:

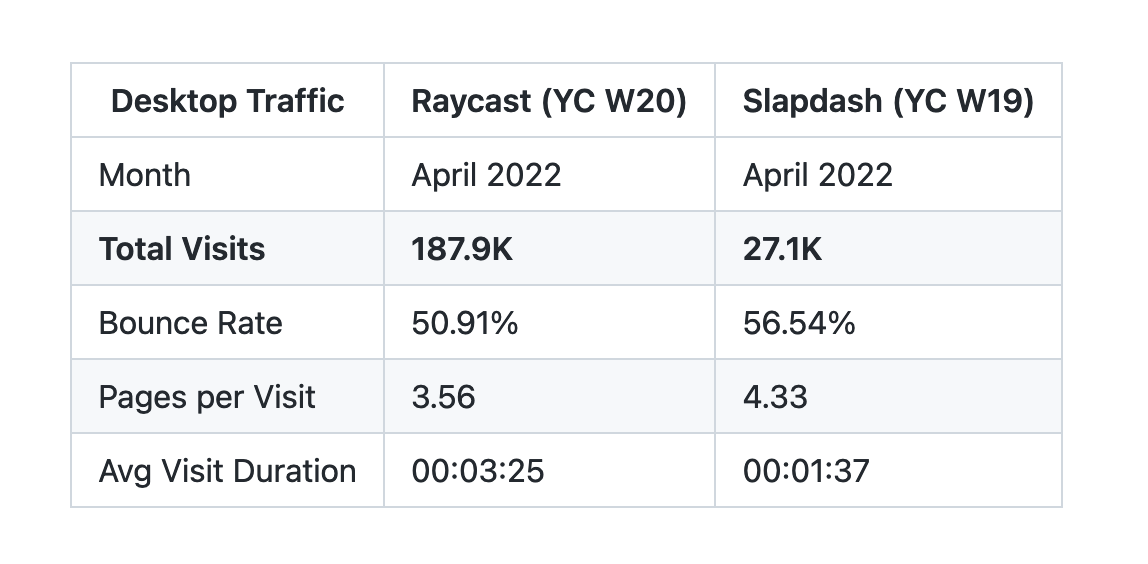

But the curious thing is that, Raycast has pulled ahead relative to its closest rival with impressive growth numbers, as can be seen in the stats in table below:

The Raycast website received an estimated 187.9K visits versus Slapdash’s 27.1K estimated visits for the month of April 2022. IOW, Raycast received nearly ~7x the amount of traffic received by the Slapdash website.

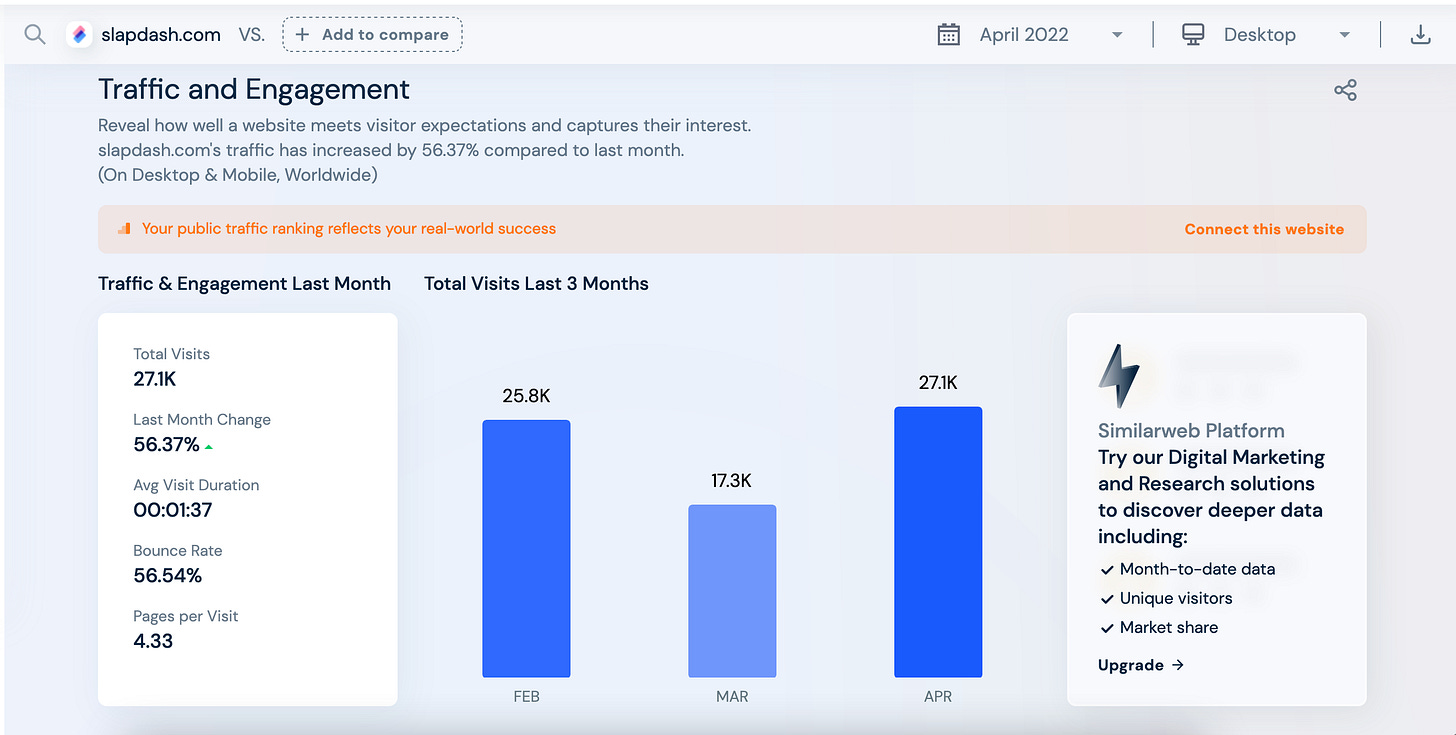

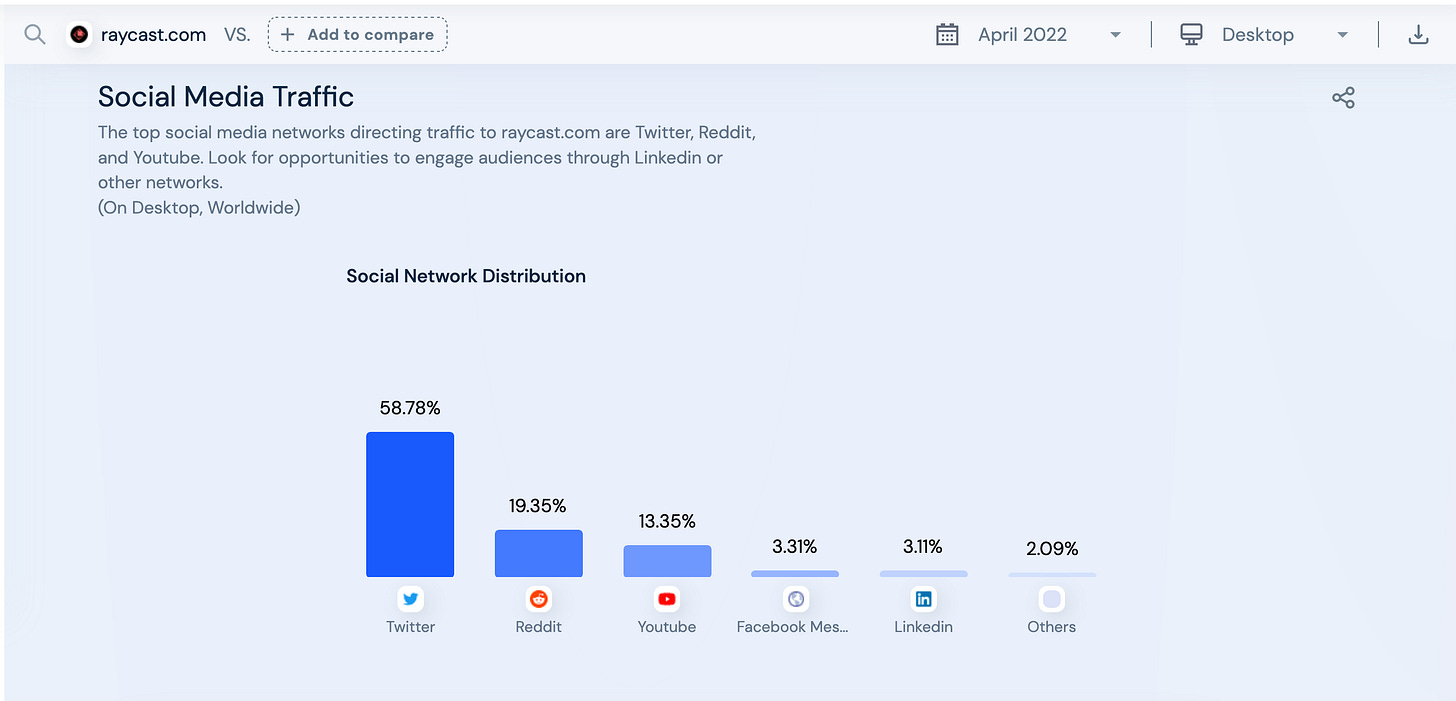

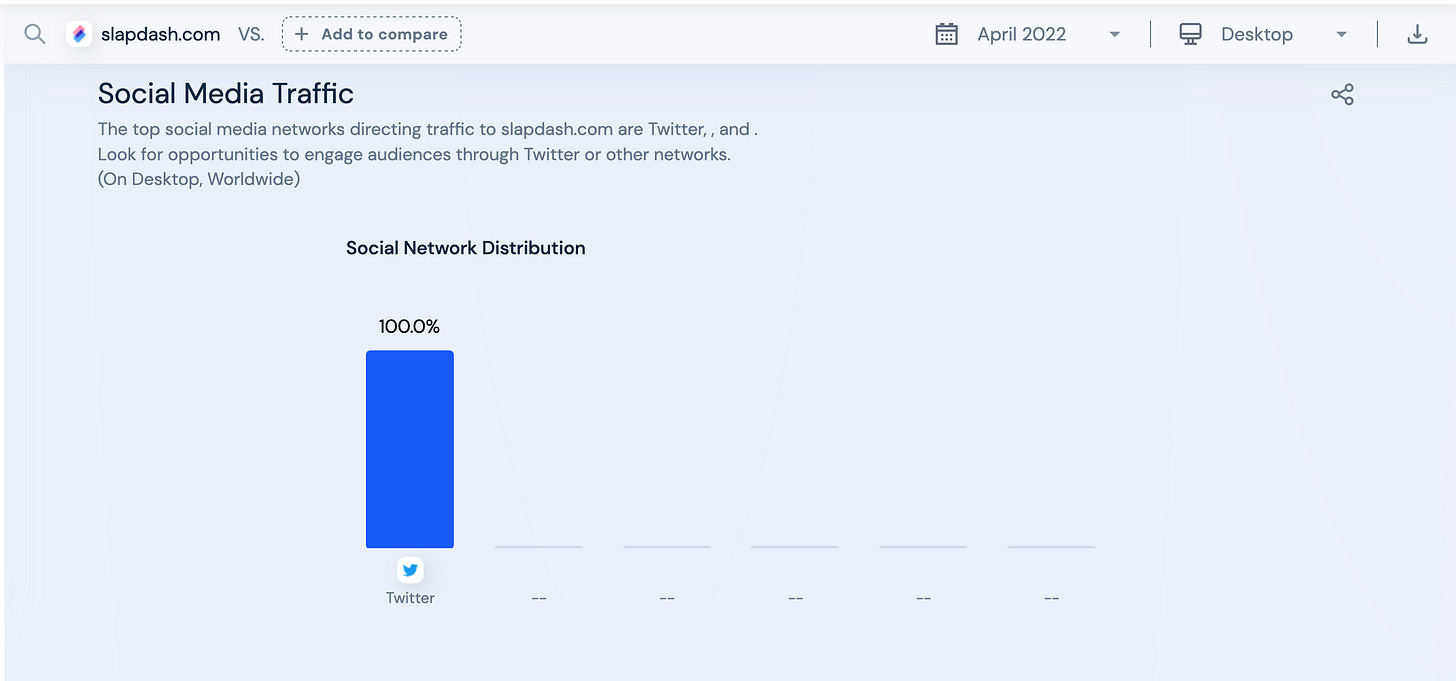

Below are additional screen shots showing more data. It provides additional estimates for their respective websites with respect to:

Traffic and Engagement

Social Media Traffic

1.3.1.1. Traffic and Engagement

1.3.1.2. Social Media Traffic

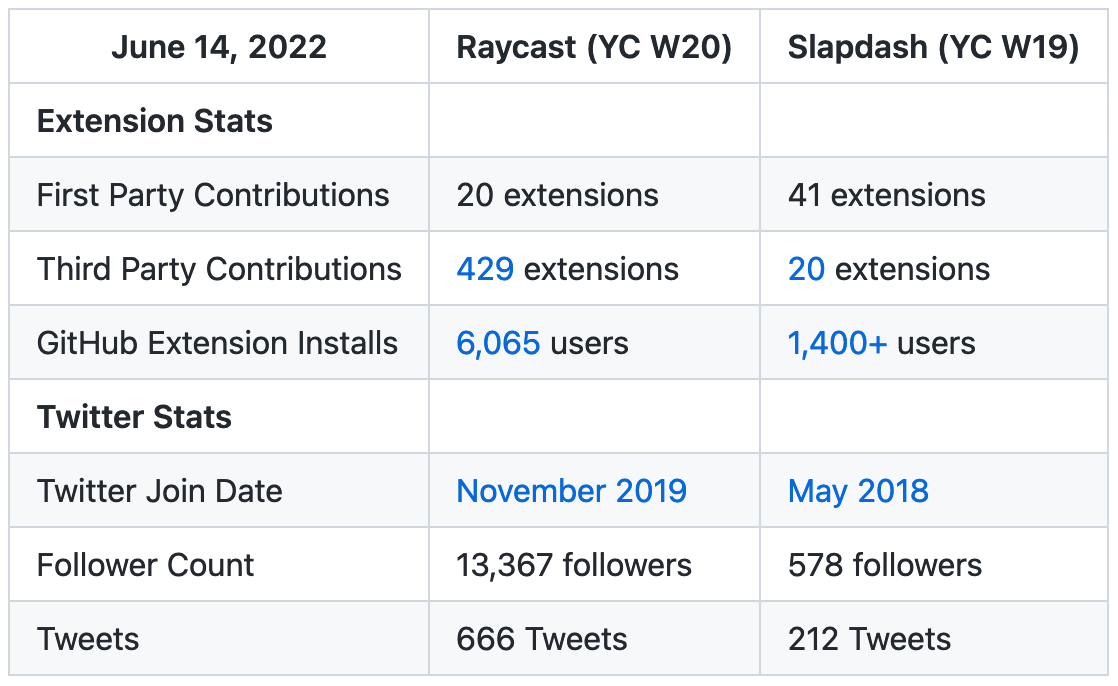

1.3.2. GitHub and Twitter Statistics

Not only is Raycast ahead on website traffic numbers, they have more third-party developers contributing extensions to their ecosystem, plus more users have installed their GitHub extension.

As you can see in the stats below, they also have a strong presence on Twitter.

1.3.3. Why the Huge Disparity?

To understand how Raycast was able to pull so far ahead of Slapdash, even though Slapdash was first to market, we need to take a closer look at the things they did and more importantly, the things they did not do.

We’ll delve deeper into the positioning of each startup in the next chapter.

2.0. Raycast

2.1. Competitors

Raycast belongs to an established category of apps called desktop app launchers.

In the previous chapter, the HN community compared Raycast to five (5) alternatives. Two of those alternatives are macOS only, two are cross-platform while one is Windows only. Since Raycast itself is still macOS only, we will limit our discussion to the Apple ecosystem.

Its predecessors in this category are just a five (5): Apple Spotlight (2005) and four (4) by third-party vendors: LaunchBar (1996), Quicksilver (2003), Butler (200320) and Alfred (201021).

2.1.1. App Launchers Rise and Fall

To get a sense of how popular each of these third-party app launchers are, let’s look at download statistics from MacUpdate, which is a third-party app distribution site that has been around since 1997.

In descending order of download numbers, Quicksilver has been downloaded more than 776k times22, Alfred has been downloaded more than 200k times23, LaunchBar has been downloaded nearly 190k times24, while Butler has been downloaded more than 116k times25.

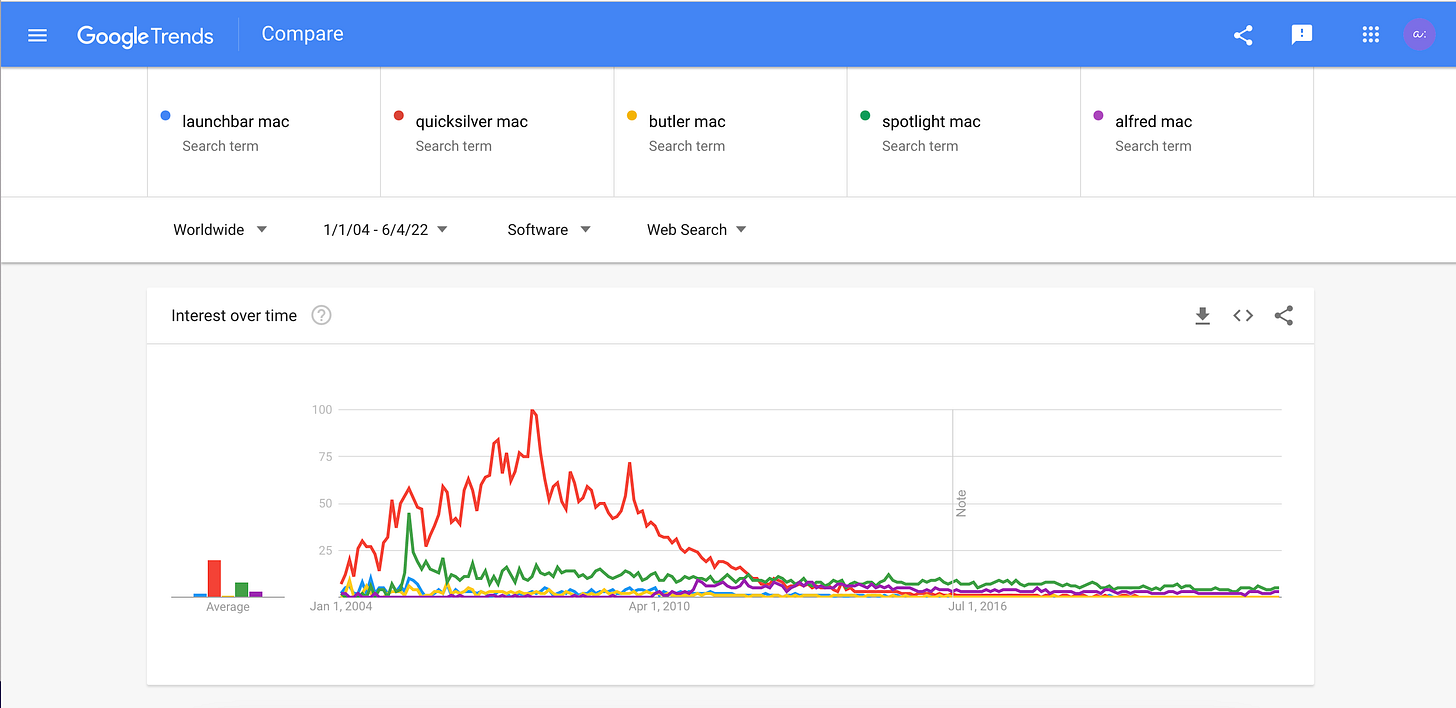

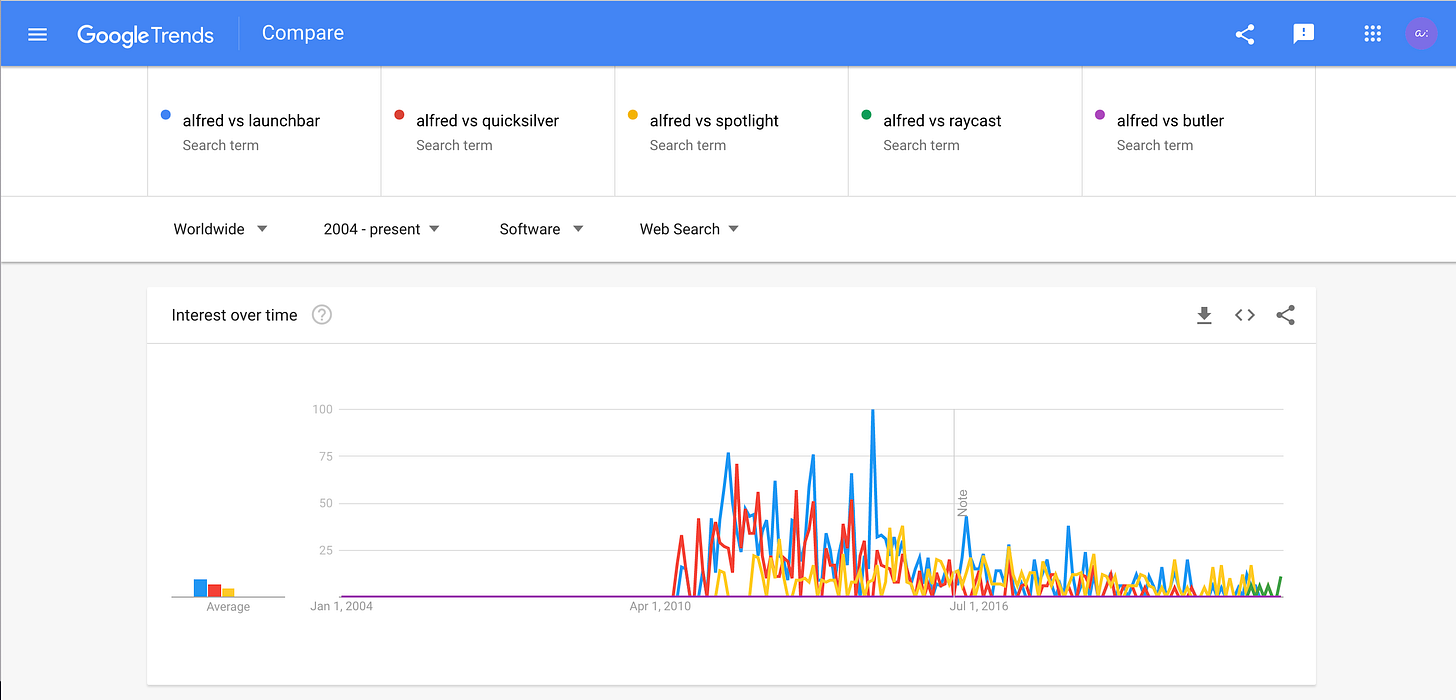

On the surface, it’s easy to think that Quicksilver and Alfred are the most popular third-party app launchers today, so let’s sanity check the data by comparing search interest for these apps with Google Trends data:

The downward trend lines in the chart taken from Google Trends tells a much more nuanced story. To properly understand what’s going on, a short detour on how people use Google to aid buying decisions is in order.

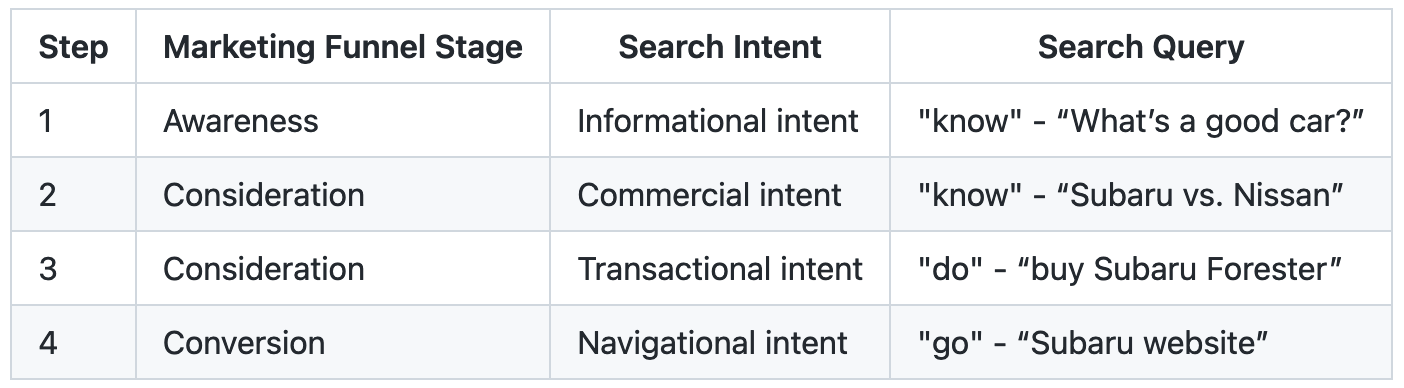

2.1.2. A Primer on the Buying Cycle & Search Intent

Zero Moment of Truth: “Know,” “Do” and “Go”

According to a Search Engine Land article on the buying cycle26, the most critical point in the buying cycle—known as the Zero Moment of Truth (ZMOT)—is the point when users conduct three (3) types of search queries before making a purchase.

These search queries are known as: “know”, “do” and “go” search queries.

Search Intent

According to a Semrush article on search intent27, “search intent is the purpose of a user’s search”. It is the motivation behind why a search query was conducted.

Search intent can be broadly grouped into four (4) buckets:

navigational intent: trying to find something (e.g., “Subaru website”)

informational intent: trying to learn more about something (e.g., “What’s a good car?”)

transactional intent: trying to complete a specific action (e.g., “buy Subaru Forester”)

commercial intent: trying to learn more before making a purchase decision (e.g. “Subaru vs. Nissan”)

Relating Search Intent with Search Queries

If we map the 4 types of search intents to correspond with their respective search queries during the ZMOT in the buying cycle28, we get the arrangement below:

Armed with this information, let’s make sense of the downward trend lines in the previous chart from Google Trends.

2.1.3. Alfred: Leader of the Modern Era

Apple Spotlight

Using “spotlight mac” as the search query for Spotlight, we see that since Apple’s June 2004 announcement and subsequent April 2005 launch, interest in Spotlight peaked in May 2005—one month after launch—and it has never reclaimed that peak.

Unlike the other four app launchers which are made by third-parties and thus need to be installed manually by a user, Spotlight comes installed on all Macs. There’s no way for a user to download it, only to learn how to use it or learn what it is capable of.

So, we can safely conclude that the intent behind searches for Spotlight hovers between steps 1 and 2 in the buying cycle.

The other thing is the steady decline in search volume for app launchers in general. For a lot of macOS users, Spotlight is good enough.

Quicksilver and Alfred

For the search terms “quicksilver mac” and “alfred mac” which search for Quicksilver and Alfred respectively, we see that Quicksilver has indeed enjoyed a great run in terms of popularity, up until the 2010s, when Alfred started to rise in popularity.

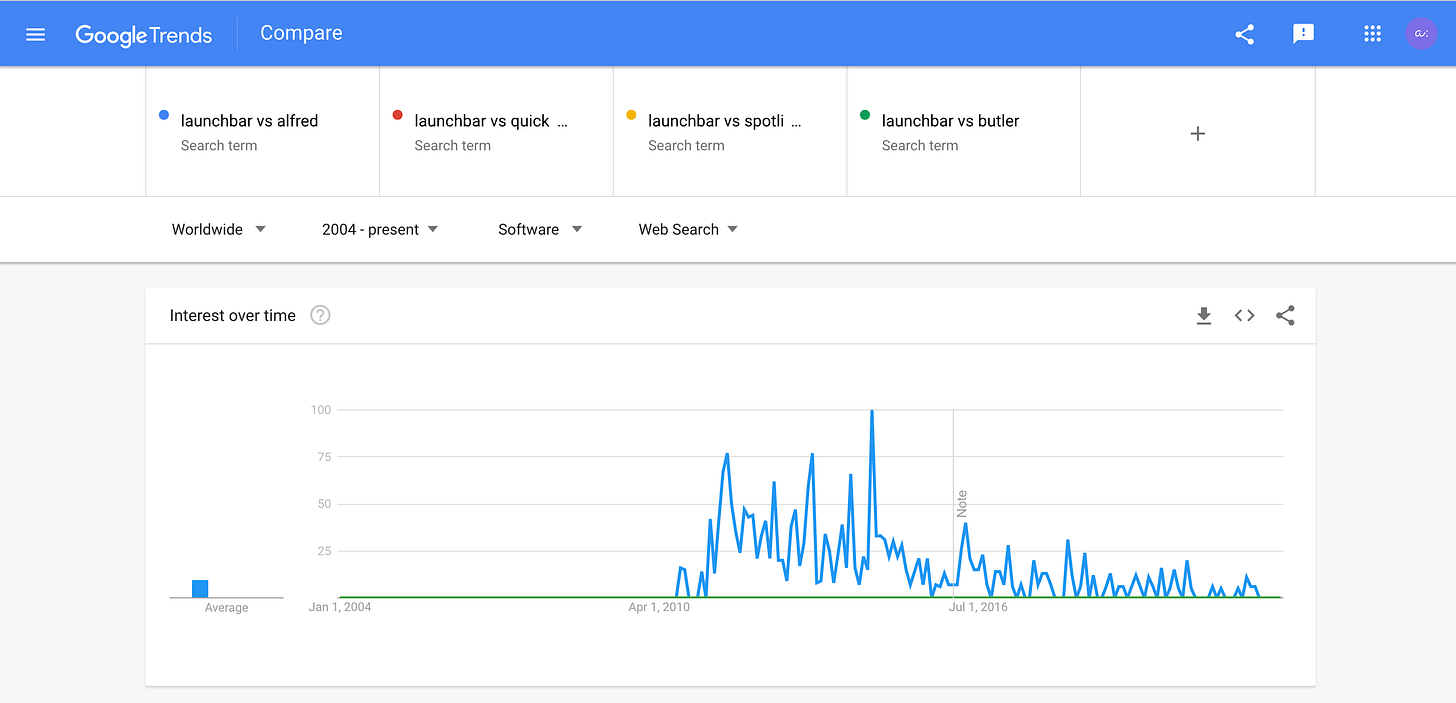

Quicksilver got compared with Alfred far more than the other 4 app launchers.

LaunchBar and Alfred

Again, when we compare LaunchBar with 4 app launchers on Google Trends, only the combination29 that includes Alfred i.e. “launchbar vs alfred” was commonly searched for by consumers:

The huge spike around June 2014, was due to a major launch for LaunchBar. LaunchBar is a paid product and they courted interest in March 2014 with a public beta for the upcoming version 6 release, which was the last major release accompanied by a visual refresh. At the end of the beta, version 6 was made available for free30.

Alfred

Today, Alfred is the most searched for app launcher on macOS, outside of Spotlight.

Comparing Alfred with 5 app launchers on Google Trends:

The chart also tells an interesting story: consumers are comparing Alfred with Raycast—the up-and-coming app launcher

Let look at how Raycast has been able to steadily gain market share against the incumbent.

2.2. Positioning

They’ve stated that “Community is a the center of our company strategy with the ambition to become a ubiquitous productivity tool for developers.”

Your strategy is often a good proxy of how well you really understand a competitive environment and as we will see below, Raycast’s leadership have an excellent handle on their competition. I’ll illustrate by comparing several of the decisions they’ve made that contrast with decisions made by Alfred, the incumbent.

Alfred and Raycast

In their product philosophy as well as marketing, when contrasted with Alfred, it is clear that Raycast optimizes for:

regular over occasional updates;

short over long feedback loops;

full vs limited user experience;

ergonomics over complexity;

integrated over disjointed extension ecosystem;

2.2.1. Product & Marketing Channels

2.2.1.1. User Feedback: Single vs Multiple Touch Points

They maintain multiple channels where users can share feedback via:

in-app email—viewable only to the team;

Slack—viewable to the community & team;

Twitter—viewable to anyone.

2.2.1.2. Occasional vs Regular Updates

They sustain interest in the product by releasing regularly and publishing a changelog—a summary of what has changed. The changelog is published on:

the website;

Slack;

Twitter and;

in a monthly newsletter.

2.2.2. Community: Short Feedback Loops

They are very intentional about where they host their community and how quickly they respond to inquiries.

2.2.2.1. Forum vs Slack

Their community is hosted on Slack instead of a Forum. For more background on the significance of this decision, please refer to the appendix: Library vs Conversation.

2.2.2.2. Slow vs Fast Answers

They have on-call rotation for the team so that questions don’t go unanswered on Slack for more than 48 hrs.

3.0. Slapdash

3.1. Competitors

Slapdash belongs to a fairly broad category of apps called Work OS. This product category is really nebulous relative to Raycast’s. This was apparent in Slapdash’s LHN post where they got compared to far more competitors than Raycast.

IOW, Slapdash is in a crowded market, which means that every single marketing effort will be hamstrung until it is properly acknowledged with an appropriate strategy.

Before we outline their more than two (2) dozen competitors, it is important to get a sense of just why their market is so crowded. To help us, we will borrow the concept of problem space vs solution space from the discipline of product management (PM).

3.1.1. The Problem Space

Productivity Paradox Redux

The steady growth in the average number of apps used in the workplace has led to a resurgence of the productivity paradox for knowledge workers.

To get work done, in the modern workplace, employees now:

spend time switching between between multiple apps;

experience difficulty locating work information across multiple apps.

The pandemic induced switch to WFH introduced an additional set of challenges but we will focus on the first two for now.

3.2.1. The Solution Space

Context Switching

The underlying job-to-be-done (JTBD) for Raycast and Slapdash is to allow a user to context switch, i.e. allow efficient switching between multiple activities.

On most modern operating systems, there are three (3) types of contexts31:

immediate context—scoped to a window;

intermediate context—scoped to an app;

broad context—scoped to the OS.

A knowledge worker’s job responsibilities will almost always dictate what apps s/he can use. How the apps are delivered will in turn determine where that worker will spend the most of his/her time when using a computer.

Stated differently, workers that depends on several native apps and a handful of SaaS apps will spend the bulk of their time context switching between native apps and the browser.

Whereas, workers that depends on several SaaS apps and only a handful of native apps will spend the bulk of their time context switching between browsers tabs (inside the browser).

To be concluded.

4.0. Appendix: Library vs Conversation

4.1. Forum vs Slack

Getting help is online is a mixed bag depending on the medium.

4.1.1. Forum

Forums usually adhere to certain netiquettes—long standing guidelines that might not be familiar to new comers. New comers are expected to use the search feature to see if a similar question has been asked, before posting a new question, otherwise they stand the risk of having their question closed or marked as a duplicate of an existing one. Another is the expectation that new users should pick the “correct” forum category before posting, and to come up with a descriptive title for new posts.

The reason for this is because forums are often treated like libraries. Libraries are publicly accessible—anyone with a similar question will be sent there by Google, which is why there is so much friction before a new comer can get their question seen, yet alone answered.

4.1.2. Slack

Slack, OTOH is often treated like a long-running conversation, which is why it has far less friction for new comers. Rather than burden new users with tradition, if a new user asks a question that has been answered before, existing users often offer a helping hand by pointing the newcomer to the answer. This shortens the feedback loop for the new comer.

Two major benefits of Slack for support over forum software in general is that,

Millions of people use Slack for work which makes it familiar, unlike to the myriad of forum software out there. Add to the fact that Slack users often have it installed one more than one device, with notifications enabled. This vastly increases the likelihood that a Slack user will to be notified immediately or shortly after, when they receive a response. A forum user, OTOH might even not have a valid email associated with their account when they signed up.

Because forums are public, some forums software do not enable support file uploads by new accounts (due to the moderation burden being a game of wack-a-mole) and when they do, user submitted files like logs and screen shots will often get indexed by search engines, all of which adds friction for the new comer. Because Slack is treated like a private conversation, new comers are less likely to hesitate to share sensitive logs or screenshots of their environment when they are in the middle of resolving whatever issue they are facing. Sensitive files can always be deleted later and they are less likely to end up on search engines.

As the community grows, the short feedback loop between questions and answers, updates etc eventually engenders a sense of belonging among participants. This in turn fuels the urge to share excitement about product with other people—a great way to grow via WoM.

Of course past a certain community size, a conversational medium like Slack will be harder to manage than a regular forum.

5.0. Appendix: Go Wide vs. Go Deep

5.1. Raycast: First Encounter

I first learned of Raycast when I saw their job ad on the HN frontpage in December 2020 seeking to hire macOS Software Engineers.

When I saw repeats of the ad through out 2021, they’d modified the CTA to link directly to their open jobs instead, along with a few tweaks to the copy of the headline. Notable tweaks were in January 2021 [a:], February 2021, and December 2021 [a:], but there is one thing that has stood out.

They’ve had an opening for a Developer Advocate position since December 2020, and nearly 18 months later, that role still appears to be open. After reviewing an archive of the original Developer Advocate job description, comparing it with an archive of the current job description, I get a sense that they are not in a rush to have the position filled, perhaps because of how important the right hire is to their strategy.

5.2. Slapdash: First Encounter

I first came across Slapdash while casually browsing the productivity section on the Electron showcase page on December 19, 2021. Slapdash have a witty tag line where they call themselves “The operating system for work”.

To learn more, I conduct a few searches and I noticed that, unlike Raycast, they are present on quite a few marketplaces:

A few more searches and it turns out they actually went through YC before Raycast. They even did a launch post on HN, also in 2020. Jackpot!

5.3. Contrasting Philosophies

Raycast and Slapdash have both been characterized as “unified search apps” and while this characterization is true from the perspective of a potential customer, they couldn’t be more different in terms of their philosophy and approach to how their products are marketed.

Their philosophies are almost popular opposites, a classic case of deciding to go wide versus deciding to go deep.

I already had a hunch as to which startup had the more effective long-term strategy, assuming they both plan to remain independent, but the stark contrast nerd-sniped me—perhaps this could make for an interesting multi-year case study on startups led by technical founders?

Eventually, on December 20, 2021, I decided to interrupt the desk research I had been doing—compiling a developer marketing playbook for devscape.co—targeted at DevRel and PMM (Product Marketing Manager) folks. I started taking notes about their respective strategies, hoping that in a year or two, I would revisit.

It doesn’t matter now—Slapdash sold to ClickUp on April 26, 2022.

YC owns the product analytics space, May 11, 2021

Freshpaint pivoted to their current product to become a Segment competitor.

Hacker News (HN) is a popular news aggregation site similar to Reddit and is frequented by software engineers and entrepreneurs. It is funded by YC.

This HN post Ask HN: How do you search across multiple tools (Slack, email, Gdocs)? from 2019 mentions Slapdash in this thread.

“Raycast is intended for developers but we had designers, product managers and others in our private beta that enjoy our built-in extensions for Jira, G Suite and Zoom.” via Show HN: Raycast (YC W20) – Spotlight for Developers.

The company that makes a product of the same name CommandBar was founded a few months earlier, specifically in May, 2020, before Slapdash’s public launch in September 2020. ClickUp, the company that would go on to acquire Slapdash in April 2022, is listed as a CommandBar customer on their home page [a:] as well as in case studies [a:].

Google showed https://www.internalfb.com/ as an alternate URL for accessing FB Intern.

“Don't write in a marketing, sales, or PR style. On HN these things backfire.

As founders, you mostly talk to users, customers, or investors. Put those habits aside for now. HN readers are your peers, and it doesn't work to talk to peers that way.” — Launch HN Instructions

Raycast had 49 member comments which was calculated as follows:

total comments: 76;

team comments: 11 (by thomaspaulmann, co-founder) + 16 (by pitnikola, co-founder) = 27;

community comments: 76 - 27 = 49.

Slapdash had 45 member comments which was calculated as follows:

total comments: 68

team comments: 21 (by kanevski, co-founder) + 2 (by dimitriko, co-founder) = 23;

community comments: 68 - 23 = 45.

Although Command E was acquired by Dropbox on October 29, 2021, the app was originally “available for download on Mac and PC” during their private beta, according to reporting by TechCrunch in May, 2020.

FYI started out as a browser extension for Google’s Chrome browser.

UKTN: Developer productivity tool Raycast raises $15m, Nov 30, 2021

Protocol: Meet Raycast, the remote control for your work life, March 15, 2022

The two extensions are: Slapdash which adds a Command Bar to Chrome and enhances access to Chrome if the Slapdash desktop is installed; and Slapdash New Tab which sets Slapdash as your New Tab page in Chrome.

Chrome Stats: Historical stats trends for Slapdash: 1,000+ users, 8 ratings on December 20, 2021; 1,000+ users, 9 ratings on Mar 15, 2022.

IndieHackers: Engineering as marketing can be powerful in itself, May 18, 2022

Wired Magazine: Software Makes a Tiger of Panther, Jul 6, 2004 mentions “Objective Development's LaunchBar, Blacktree's Quicksilver [and] Peter Maurer's Butler” which points to Butler being around since at least 2002-2003. Butler’s release notes [a:] point to 2002, as there are mentions of compatibilty issues with Mac OS X 10.2 "Jaguar", which was released in 2002.

Alfred launch story: Behind the App: The Story of Alfred in Lifehacker, August 20, 2014

Quicksilver: downloaded from MacUpdate 776,405 times as at June 4, 2022

Semrush: What Is Search Intent? A Complete Guide, Feb 18, 2022

Of course the customer’s path during the buying cycle is not linear. I adopted a 4-step path for simplicity.

Consumers in steps 1-2 of the ZMOT will typically search for “<app-launcher-1> vs <app-launcher-2>” as part of their consideration in the buying cycle.

If we pick LaunchBar to be the category leader by virtue of being the oldest, then all four search queries should have returned results:

launchbar vs alfred

launchbar vs quicksilver

launchbar vs spotlight

launchbar vs butler

A discussion of LaunchBar version 6 [a:] being free on Reddit, June 14, 2014; and a Macworld review a day later; and an article on its history: Command Space: A Review of LaunchBar and a History of Application Launchers, June 11, 2014.

Devs in mind: how to design interfaces for developer tools, April 19, 2022